The week that was:

Markets displayed the usual coronavirus disease (COVID-19) yoyo, rallying on news that a vaccine was 90 percent effective and losing some of their gains once the reality of manufacturing and distribution set in.

The Eurozone economy grew 12.7 percent in Q3 according to Eurostat. This is hindsight; the new restrictions and lockdowns across the continent will adversely affect GDP numbers going forward.

India’s GDP contracted 8.6 percent during 3Q, compared to 24 percent during 2Q, putting the economy into recession.

Estimates by the General Authority of Statistics say Saudi Arabia’s GDP contracted 4.2 percent during Q2. While this is the fifth consecutive decline in GDP, it is considerably less than in Q2, which stood at 7 percent. The International Monetary Fund forecasts the Saudi economy to contract by 5.2 percent this year; the Kingdom was hard hit by falling oil prices and production cuts under OPEC+ arrangements, necessitated by historic demand declines due to the pandemic.

Crown Prince Mohammed bin Salman released a statement delineating Saudi Vision 2030, which is geared to ween the economy off dependence on the oil sector. According to the Saudi Press Agency oil income is expected to decline by SR 410 billion ($109.3 billion), but non-oil revenue will rise to SR 360 billion, up 14 percent thanks to the reorientation of the economy.

Ratings agency Fitch left the Kingdom’s credit rating at A, but gave it a negative outlook on account of an expected budget deficit for 2020 of 12.8 percent this year, compared to 4.5 percent in 2019.

Oman plans to transfer 60 percent of its largest oilfield (Block 6) which has a production capacity of 650,000 barrels per day (bpd) from Petroleum Development Oman to a separate company. The company should raise $3 billion from the international bond markets. This is a creative solution to Oman’s debt raising woes, as the bonds would be secured by a separate revenue stream avoiding stretching the county’s balance sheet.

Alibaba’s “Singles Day” broke records, achieving sales worth $75 billion on Nov. 11, compared to $38 billion last year.

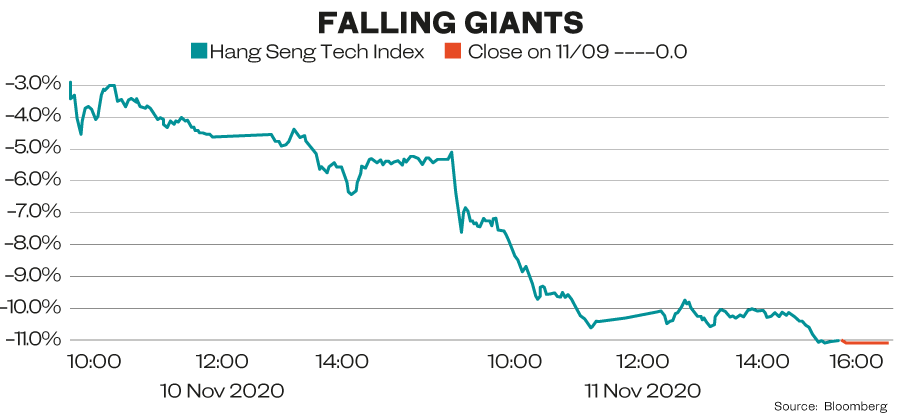

The China tech sector encountered headwinds from Beijing’s new policy to curb “monopoliztic tendencies” in Big Tech. This hurt Alibaba Tencent, Meituan, Xiaomi & co by slashing $270 billion of their valuations. Shanghai’s Index lost 6 percent on Wednesday. Over a 48-hour period these shares shed 11 percent on the Hang Sen.

US President Donald Trump issued an executive order banning US investors from owning shares of Chinese companies with links to China’s People’s Liberation Army, which knocked high single digits off telecom shares in Hong Kong on Friday. US investors have until Nov. 2021 to divest the shares.

Tik-Tok got some reprieve (a de facto postponement) from its ban by the US government. The Commerce Department announced that the ban would not go into effect until legal challenges are resolved.

The earnings season continued:

Disney shares rose 6 percent after it released stronger than expected 3Q results and reaching 73 million subscribers on Disney+ (It took Netflix 8 years to achieve a comparable number). The loss per share came in at $0.20 compared to an estimated loss of $0.71 per share according to Refinitiv. Revenues were $14.71 billion, also higher than expected.

Lyft shares similarly rose 6 percent on better than expected results. The company reported a 3Q loss of $460 compared to 463 in 3Q 2019. Revenue and ridership increased considerably compared to Q2. Management expects Lyft to turn profitable by the end of 2021.

Rosneft reported sales of $78 billion and a net income of $409 million for the first 9 months of the year. The company did however not manage to post a profit in Q3.

Focus:

News of the 90 percent efficacy of Pfizer BioNTech’s COVID-19 vaccine was welcome as global cases neared 52 million, and worldwide deaths exceeded 1.2 million.

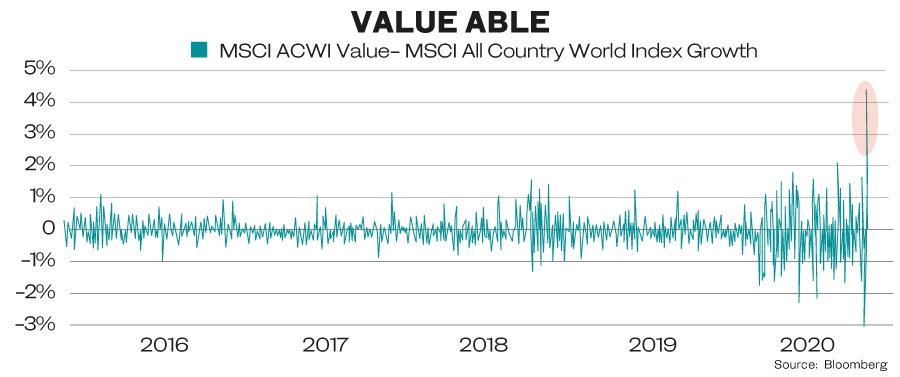

Markets reacted exuberantly. Value stocks rose and the main beneficiaries of the pandemic, Big Tech, lost. One rout does not make a rotation, and tech shares made good on their losses later in the week.

This can be explained by the fact that manufacturing a vaccine at scale will pose its own sets of challenges. Logistics and distribution are also not straightforward because the vaccine in question has to be stored at temperatures below 100 degrees Fahrenheit. Quite apart from the difficulties and expense this poses to transport, most medical institutions do not have adequate refrigeration capacity.

Three of the world’s top central bankers, the Federal Reserve’s Jerome Powell, the European Central Bank’s Christine Lagarde and the Bank of England’s Andrew Bailey, all stressed that while progress on vaccines was positive, it was not the be all and end all.

They argued that quite apart from wider availability of the vaccine being months away, the economy still needed significant stimulus to get over the recession caused by the pandemic. They reiterated concerns over growing inequality and the need for fiscal stimulus, and stressed that their institutions stood ready to address the issue within the parameters of monetary policy.

Powell, Lagarde and Bailey have a point: Monetary policy alone will not be sufficient to address the structural difficulties arising from the worst recession since the Second World War. The world economy is reeling. Nothing depicts this better than air traffic: Global aviation lost one third of its scheduled routes between January and October 2020 according to OAG Aviation Worldwide.

People will only be willing to venture out, consume and travel at pre-pandemic levels once they feel secure. According to different estimates, that will take until between the end of 2022 and 2024.

Where we go from here:

US President-elect Joe Biden, has appointed his 12-member pandemic task force and is working on his transition plans.

Brexit negotiations are dragging on with ever less runway left for a trade deal by Dec. 31. Meanwhile Prime Minister Boris Johnson’s closest adviser, and the mastermind of the Brexit campaign, Dominic Cummings, will leave 10 Downing Street by the end of the year.

China is expected to sign the world’s largest trade deal this weekend during the ASEAN summit. The Comprehensive Economic Partnership, which is Beijing’s brainchild, includes 15 Asian countries, 2.2 billion people and a combined GDP of $22.6 trillion. It notably excludes the US, Canada and other countries of the Western Pacific.

It stands in contrast to the Trans Pacific Partnership (TPP), which includes many of the same countries plus the US, Canada and Mexico and others, but excludes China. Exiting the TPP was Trump’s first action when he entered the White House in 2017. Thereafter, Japan and Canada put together the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, the TPP’s successor, without the US. It will be interesting to see what the Biden administration will do about the TPP.

— Cornelia Meyer is a Ph.D.-level economist with 30 years of experience in investment banking and industry. She is chairperson and CEO of business consultancy Meyer Resources. Twitter: @MeyerResources